This is the fourth part of “Our BTO Journey” series where I intend to share my complete journey buying a BTO flat.

In this article, I’ll write about Enhanced Housing Grant (EHG) Approval and the second appointment at HDB where we signed the agreement for lease and made downpayment for the BTO flat.

OUR BTO JOURNEY SERIES

Part 1: Why BTO?

Part 2: Application and Balloting

Part 3: Flat Selection

Part 4: EHG, Signing of Lease, Downpayment

In my previous article, I wrote that I selected my flat for Feb 2021 BTO in May 2021. We were told by the officer that the second appointment would be in 4 months time, but the Option to Purchase (OTP) that we signed is valid for 9 months from May 2021. So, there’s a possibility that the second appointment could be delayed up to Feb 2022.

In the Part 2 article, I wrote that we applied for HLE (HDB Loan Eligibility Letter) back in Feb 2021 and it got approved in 6 calendar days (which is in late Feb 2021). An HLE is valid only for 6 months, hence my HLE validity is only until late August 2021.

When August rolled around, I did not know whether I needed to renew the HLE or let it expire because HDB website didn’t mention that HLE will be required for 2nd appointment, but in one of the document we got from 1st appointment, it’s implied that valid HLE is required for 2nd appointment. It’s been 3 months since our first appointment and we hadn’t received any news about grant or second appointment yet.

I decided to call HDB general hotline to ask about this matter. The person on the other side of the line said that generally HLE is not required for 2nd appointment but she can’t give a confirmation. She asked me to call the HDB officer-in-charge of our transaction. Her name and number is stated in one of the document we received during first appointment.

I then tried to call our officer-in-charge, however, I could never reached her through the phone, she was always not picking up (perhaps she works from home). After like 3 failed attempts to reach her, I decided to leave a voice message.

She gave me a call back later on that day (I’m impressed!). She confirmed that HLE is not required for 2nd appointment. I also took this chance to ask her when our 2nd appointment will be. She said that our grant application is currently being processed, but she is not sure when the grant will be approved and when 2nd appointment will take place.

I also told her that I have salary revision recently and I asked whether I need to submit it again for EHG, and whether it will affect EHG evaluation; she replied no, the evaluation is done based on the cut-off period which is 12 months prior to BTO application (I’m guessing the months between BTO application and 1st appointment also affect the evaluation because we had to submit the latest 15months CPF transaction when applying for EHG during 1st appointment).

To be honest, we were prepared to wait for 9 months for the second appointment. So, we were totally surprised to receive a hardcopy letter (not email/sms but hardcopy letter) from HDB in the first week of August 2021, merely a couple of days after my conversation with our HDB officer-in-charge.

The letter stated “We have received your application for the Enhanced CPF Housing Grant (EHG). We are processing the application and will inform you of the outcome in about four weeks’ time. You can also check the outcome by logging on to MyHDBPage via HDB InfoWEB. We will write to you separately on the signing of the Agreement for Lease after the EHG is approved.”

This gave us hope. That means, in 4 weeks time, we can expect grant approval, yay.

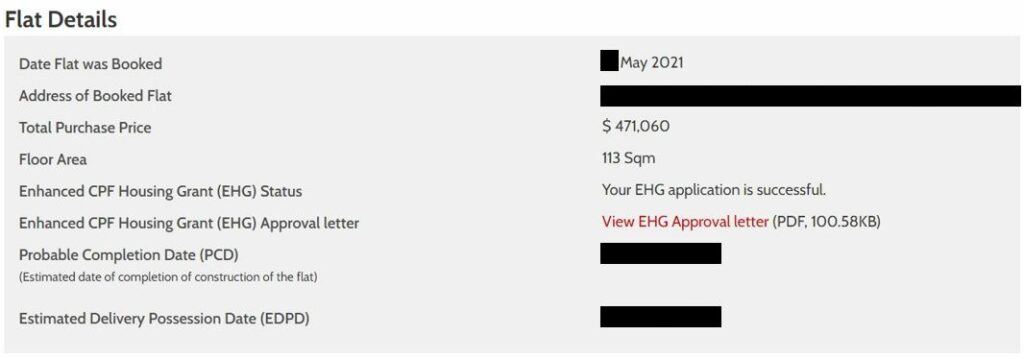

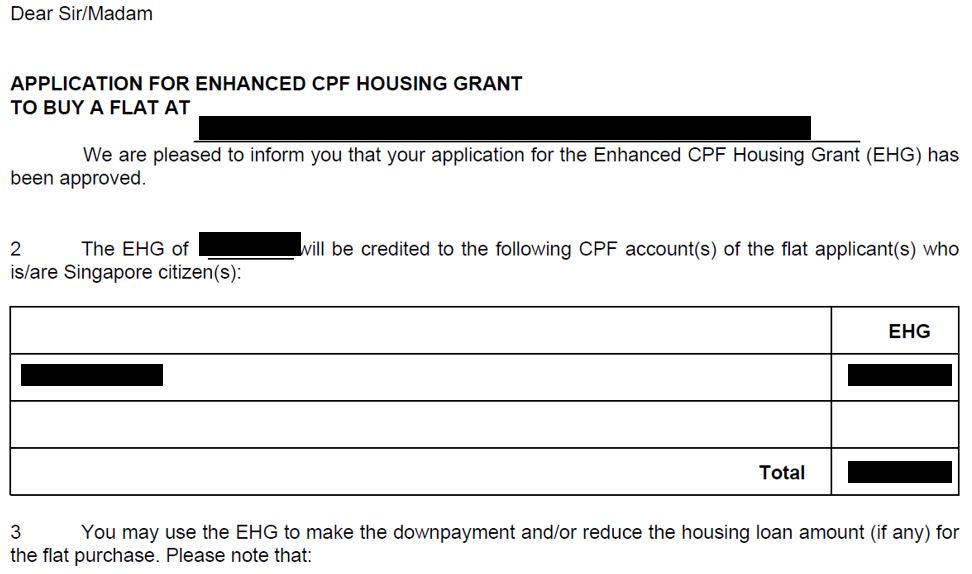

By mid August, we received email about EHG Approval (no sms, just email). It says that our EHG application has been processed and the outcome can be viewed by logging in to HDB website.

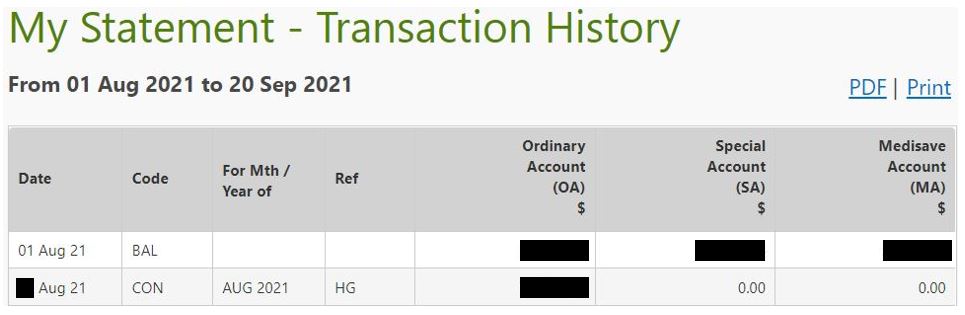

The EHG grant monies reached our CPF account the next day after the approval. It is credited into our OA (Ordinary Account).

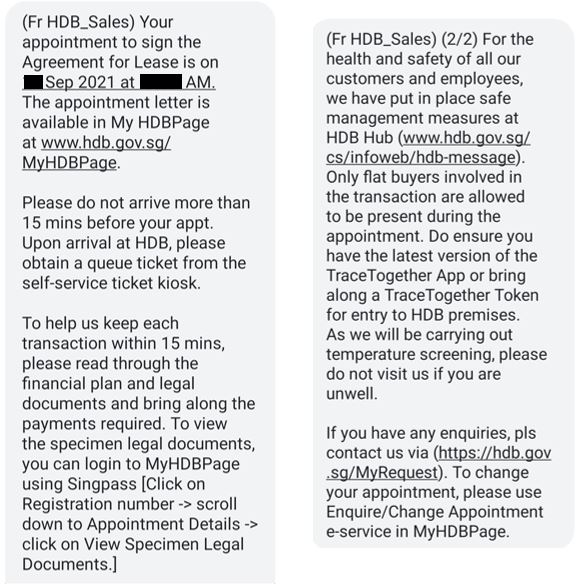

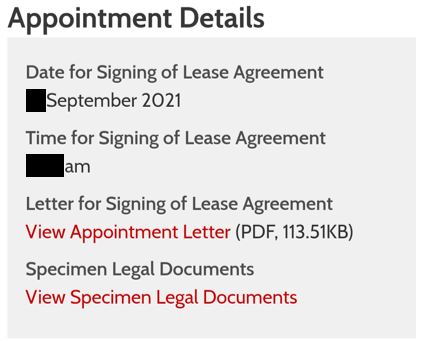

3 days after grant approval, we received SMS regarding our second appointment, which is scheduled in mid September 2021. We immediately logged in to HDB portal to download the appointment letter.

I don’t know about other people, but for us, there is an Annex listing the things we need to prepare for the 2nd appointment. They are:

We both have been using Singpass mobile app and SMS 2FA for many years now, and we always carry our IC with us. So, basically we did not have to prepare any documents at all!

There is a form in the appointment letter that asks us to choose the manner of holding the type, the options are either “Joint Tenancy” or “Tenancy in Common.” We needed to tick one, and signed in front of a witness. So, we didn’t print this form at all. In the next page after this form, there is an FAQ explaining the difference between both ownership.

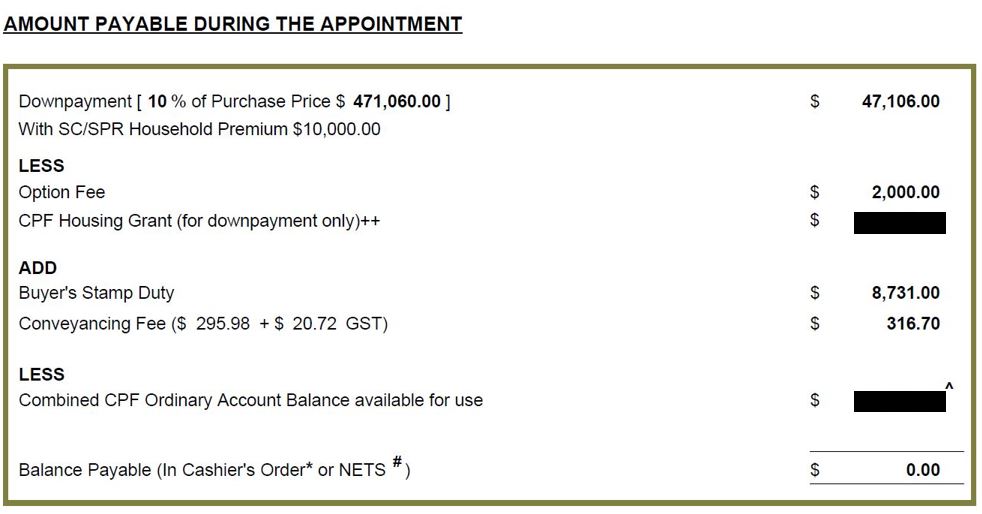

Other than Singpass and IC, we need to make sure we have enough money in CPF to make downpayment. There is a table showing the amount we need to pay when we sign the agreement of lease. Because our CPF OA + EHG grant is more than the required downpayment + stamp duty + legal fees, we didn’t have to top up with cash.

For people who don’t have enough CPF OA + EHG grant, they’d need to prepare a cashier’s order, cash / credit card are not acceptable.

On the day of 2nd appointment, we went to HDB empty-handed. We took the Q number from the machine at 1st storey. When our number was called, we realized it’s on the 3rd storey, so we hurriedly took the escalator up.

By the time we reached the room at 3rd storey, we have forgotten our counter number! Who can remember some random number from 3 mins ago?? Fortunately, there is another screen in that room for forgetful people like us. FYI, the screen is hidden in a corner and you won’t know its existence unless you asked an HDB staff.

Then, we walked to our designated counter. The HDB officer first gave us the form regarding the manner of holding the flat to fill up and sign. Then, he asked us how much to deduct from each of our CPF. After we told him, he proceeded to deduct according to our decision. We had to authorize the CPF deduction by using Singpass to login to HDB Portal and clicked on a link to make the authorization.

After signing many papers later, we were done! The entire process took us about 15 minutes. One milestone checked!

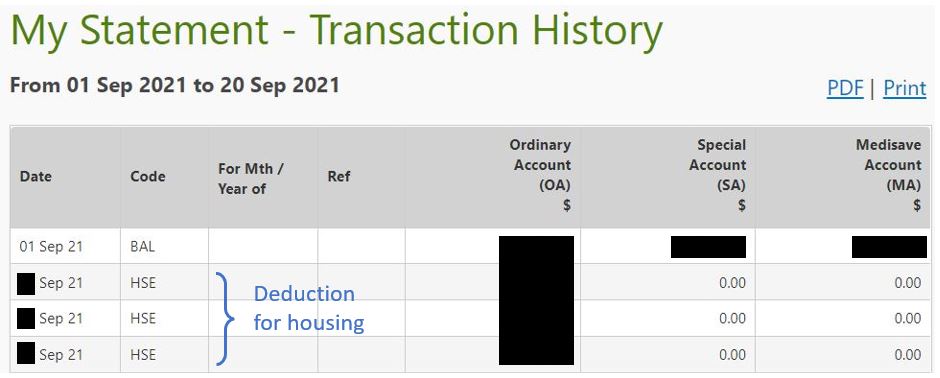

I thought that the monies will be deducted from our CPF immediately, so after the appointment, we logged in to CPF website to check. Well, apparently the deduction was not immediate. The deduction took place 3 days later. You can see the transaction by going to: My Statement > Section B > Transaction History > Choose the date range > Click “View”

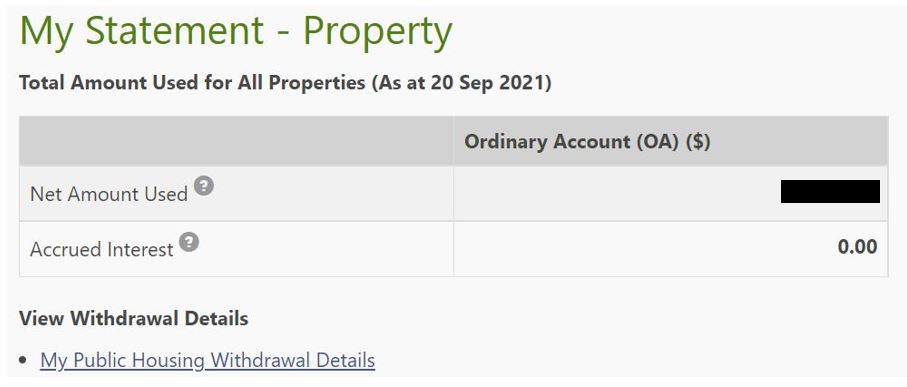

To check how much CPF you have used to buy a house and how much interest you have accrued, you can go to: My Statement > Section C > Click “Property”

My accrued interest is still 0 because it is still less than 1 month since I used CPF to pay for housing. From what I understand, the accrued interest will be calculated at the end of the month and it’ll be displayed the next month.

I’ve mentioned before that I plan to make downpayment using CPF first, then slowly pay back to CPF to minimize accrued interest. If you are keen to do the same, you can make housing refund via 2 channels as follow.

Here’s the complete guide from CPF.

Basically, you can choose to pay through enets or PayNow. The request will be processed by CPF the next working day. Upon completion of processing, you will receive email to tell you that it is completed. The next time you login to CPF to see how much CPF you used for housing, you will see the amount has reduced by the amount of refund that you put into your CPF.

The next step is key collection, which will take place in 5 to 7 years time. In between now and key collection, I may write articles related to this BTO journey if there’s anything worth documenting and sharing.

In the meantime, if you want to get notification when I have new posts, you can subscribe to my email here:

If you find this post helpful, feel free to buy me a coffee :)

January 7, 2024

February 15, 2024

Read my part 3 article. We sent the documents online via mydoc@HDB. Not sure if this has changed or not.

Flo January 15, 2024 ReplyHello, Just wanted to thank you for your in-depth post! It really helped me as in facing such situation as well, however as per my understanding the accrued interest should only start once you have collected keys instead of point of payment (second appointment). Thank you for helping out the community! 🙂

prudentdreamer January 17, 2024 ReplyThank you Flo for your kind words! Regarding accrued interest, mine has already started. That’s because once the CPF grant enters my CPF account, it’s counted as my CPF monies. And once I use the CPF grant to pay for downpayment, it’s considered as CPF withdrawal, hence the accrued interest has started. Hope it clarifies! 🙂

Edward April 5, 2023 ReplyHi, may i check? for HLE if expired before signing agreement for lease for bto, must I renew it before going for my 2nd appointment I am not taking any grant.

Kim February 18, 2023 ReplyTx for yr article, really helpful. Re EHG, I know it’d inversely proportionate to income earned,

Qn.

1. When do u have to apply for the EHG? 2. How do u apply for the EHG?

Is it online during application for flat?

Or at a separate timing ? Can advise?

Hi Kim,

1. You apply when you get the appointment date (read the Part 2 of my BTO Journey)

2. You can apply online or/and during flat selection (read the Part 2 of my BTO Journey)